Company Outline

Fair Go Finance offers small loans up to $2,000 and personal loans up to $10,000. The business was established in 2008, and its headquarters are in Perth, Western Australia. The business is open Monday through Friday from 6:30 AM to 4:30 PM AWST and on Saturday from 8 AM to 12 PM. With credit licence number 387995, Fair Go Finance’s ACN is 134369574.

Small Amount Loans

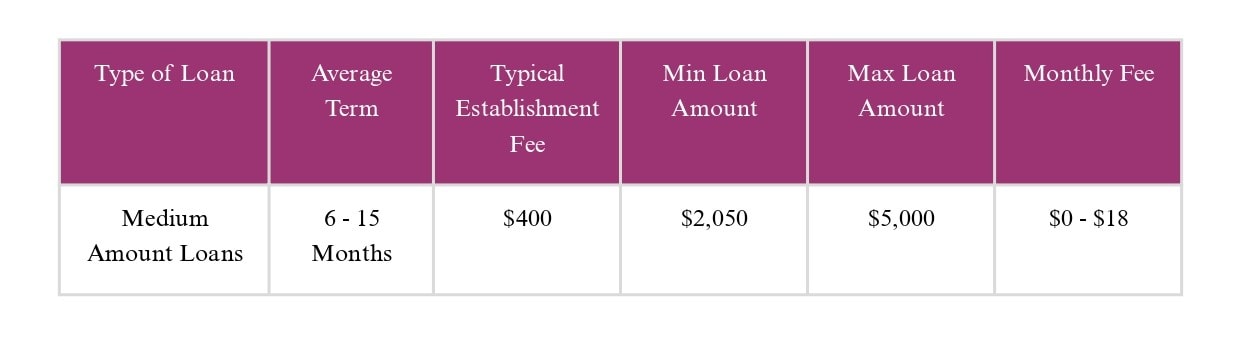

Medium Amount Loans

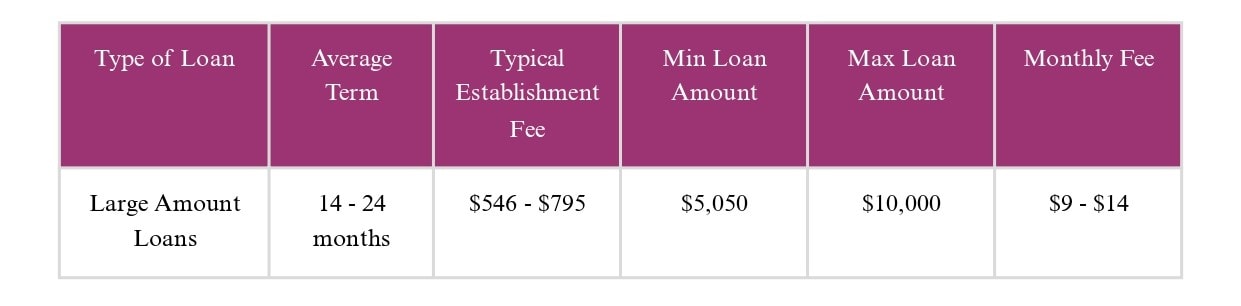

Large Amount Loans

How to Apply for Fair Go Finance Loans

All Fair Go Finance loans have an online application process. The online application should only take five minutes to complete, after which you will receive a preliminary assessment. All you have to give is your bank account details, basic identification, and information about your income and expenses. When you click the submit button, your preliminary evaluation result will show up on your screen right away.

To qualify, you have to fulfil the following requirements:

- You are eighteen years old.

- You are in Australia as a citizen, permanent resident, employee, or under the sponsorship of another person.

- You make more than $500 a week.

- You work as a full-time, part-time, or casual employee; you are not on probation.

Through the application procedure, you will need to submit the following personal information and the necessary paperwork:

Identity documents: Data from your driver’s licence or Medicare card.

Address Proof: a rent stub or utility statement that attests to your address.

Details regarding your internet banking: Your financial data for the last three months will be available to Fair Go Finance in read-only format.

Information on finances and employment: Details about your earnings, possessions, responsibilities, and employment status, including paystubs

You do not need to provide any paper copies of your documentation because the loan application process is completed fully online.

Key Features of the Fair Go Finance Loans

The swift application process and preliminary evaluation turnaround time are two noteworthy aspects of all Fair Go Finance Loans. Based on the data you submitted through the website, the company offers a 5–6 minute initial assessment to help you manage your expectations. The loan’s final outcomes are likewise disclosed in a matter of one to two business days, and the proceeds are credited in real time (provided that the borrower’s designated bank is able to utilise Split Payments technology).

You set up a direct debit agreement with your bank to make repayments. Every step of the application process is done online, and special SMS codes are used to sign documents. You might be required to provide Fair Go Finance with your online banking credentials as part of this direct debit process.

The organisation offers many solutions for loan repayment to borrowers who are having trouble making their loan payments.

Both good and bad credit applicants can receive funds. If you have a poor credit history and have not filed for bankruptcy in the last 12 months, you are still eligible to apply.

Last but not least, Fair Go offers its loyal customers a “Mates Rates” programme that increases the loanable amount on their second loan by up to $453.

Pros of Fair Go Finance Personal loans

- Quick loan approval and application processes lead to satisfied customers.

- Application that is entirely online, paperless, and uses SMS code signatures

- The extra amount that can be lent to first-time borrowers

- Set up an auto-debit account for regular payments