Why choose Monzi?

Lenders For Aussies

We’re an Australian brand, and proud. We may be 100% online, but our team is right here (behind your screen)!

No Need To Pay

The best things in life are free, right? Looking for loans? Submit your application, free of charge!

Zero Stress

We do all the legwork. Don’t sweat the small stuff when applying for loans! We can find you a lender, it’s what we do best.

Application process: 1/3

Apply Online.

Complete our application in just minutes. A loan application, without the headache.

Next step >Application process: 2/3

Lightning Outcomes.

In a flash, it’s your loans outcome! We work hard and fast to refer you to a lender

Next step >Application process: 3/3

Meet Your Lender.

We’ve found you a lender (congrats!). They should be in touch shortly

Next step >Apply online

Quick outcomes

Spend your money

Loans in your pocket.

Convenience is key. And it’s a timesaver. We find lenders who can provide top loans straight to your pocket.

100% online

Fast outcomes

Secured data

What do you need to apply?

You'll need to have

- a valid mobile number

- a valid email address

- a regular income for the last 3 months

You'll need to be

- at least 18 years old

- an Australian citizen

- or Permanent Resident

Loan amount

$300 - $2,000

Terms

16 days (minimum)

12 months (maximum)

Costs

20% upfront establishment fee

+ 4% monthly fee

Example

Representative example based on a loan of $1000 over 6 months a borrower can expect to pay a total of $1440.

Disclaimer: Under the current legislation, all Small Amount Credit Contract loan providers don’t charge an annual interest rate. The maximum you will be charged is a flat 20% Establishment Fee and a flat 4% Monthly Fee. The minimum loan term is 16 days and maximum loan term is 12 months. Representative example based on a loan of $1000 over 6 months a borrower can expect to pay a total of $1440.

Loan amount

$2,100 - $4,600

Terms

12 months (minimum)

24 months (maximum)

Costs

47.8% Annual Percentage Rate (APR)

65.85% Comparison Rate p.a.

Example

Representative example based on a loan of $2500 over 24 months a borrower can expect to pay a total of $4,556.88.

The maximum interest rate for a Medium Amount Credit Contract is 47.8%. Comparison Rate 65.85% p.a. The maximum loan term is 24 months. Representative example based on a loan of $2500 over 24 months a borrower can expect to pay a total of $4,556.88. WARNING: This comparison rate is valid only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate with the lender that finances your loan. Credit criteria and terms and conditions apply.

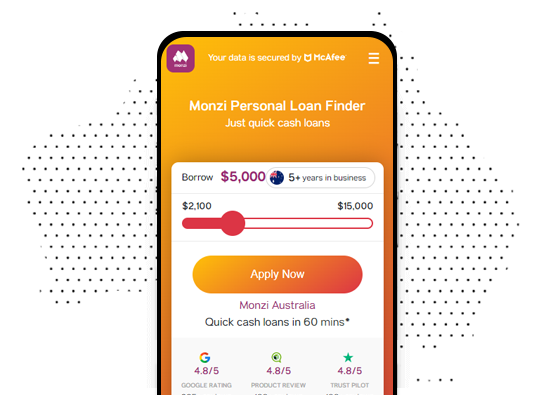

Loan amount

$5,000 - $15,000

Terms

12 months (minimum)

24 months (maximum)

Costs

47.8% Annual Percentage Rate (APR)

47.8% Comparison Rate p.a.

Example

Representative example based on a loan of $10,000 over 36 months a borrower can expect to pay a total of $18,995.04.

This is an estimate only and the comparison rate based on the example information provided. Other fees, costs and charges are not included. This calculation is not an offer for credit.The maximum interest rate for a Personal Loan is 47.8%. Comparison Rate 47.8% p.a. The maximum loan term is 24 months. Representative example based on a loan of $10,000 over 36 months a borrower can expect to pay a total of $18,995.04. WARNING: This comparison rate is valid only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate with the lender that finances your loan. Credit criteria and terms and conditions apply.

Ask away.

Transparency is at the heart of Monzi’s business and we don’t believe in silly questions.

How do I apply?

Simply, complete our application in minutes. That’s it.

What happens to my data?

Rest assured, Monzi is officially certified by McAfee and Comodo.

What can Monzi do for me?

We can find you a lender that offers the finest quick loans in Australia.

Don't wait, Apply anytime.

The time is now or whenever you like, actually. Monzi is online and always ready to find you lenders that can provide quick cash loans.

Why Monzi Loans?

The time is now or whenever you like, actually. Monzi is online and always ready to find you lenders that can provide quick cash loans.

Hi, we’re Monzi. We are an Australian brand, and proud of it. We may be 100% online, but our team is right here, behind your screen!

What do we do? Well, we’re here to make life a little bit easier for as many Aussies as possible. When everyday Australians find themselves needing an online loan, we take the hassle out of finding a lender. With one application, we search through hundreds of licensed credit providers.

So, whether you need a loan to cover a rental bond, to repair your car or for travel costs, we reckon we know the lenders who can help.

Once you’ve filled in our application form, we’ll compile all your information together. Next, we’ll pass this information on to hundreds of lenders, to try and find a credit provider who can help. Read more about buy now pay later no credit check australia and bad credit loans australia guaranteed approval here.

The best bit? We work with lenders who share in our philosophy. Therefore, if you’re in an emergency, or have bad credit, don’t run the gauntlet by applying for a no credit check loan, or payday loan. You can rest assured Monzi will only pair you with a licensed, reputable lender. Monzi cannot help you with cash loans without a photo ID, loans without ID or bad credit loans guaranteed approval. Credit checks may be part of the assessment process of the matched lender. However, Monzi might be able to help you find easy personal loans, $5000 loan, instalment loan, bond loans, bad credit loans or bad credit cash loan if you have a bad credit history. A bad credit score is not the end of the world. Apply for a bad credit loan or 100 online loans for bad credit with Monzi. If you are googling the following terms, urgent loans no credit check, emergency no credit check loans, holiday loans no credit check, $15000 personal loan, 247 payday loan, beforepay loans, unsecured personal loan, personal loan repayments, credit report, credit rating, and unsecured loans, learn more here.

The best part of Monzi? Well, we’re completely free. Yep, 100%, absolutely and utterly free.

So, it doesn’t matter if we successfully find you that quick cash lender you’re looking for, or if you don’t end up borrowing a cent, our service will always be free for our customers.

Are you in a rush? Well, we work super fast. We’ll have an outcome for you within minutes of applying. We find lenders offering cash loans, both secured and unsecured. If you’re receiving Centrelink and are looking for cash loans for bad credit, we could find you a lender willing to help.

While all lenders may vary, we are able to give you a general idea of the costs associated with short term loans.

So, whatever loan you’re looking for, big or small, Monzi’s got your back.

When you use Monzi’s lender-finder service, you can sit back, and we’ll take care of the rest.

Forget the stress that usually comes with looking for a cash advance lender. We’re completely open about how your details are kept completely secure and private.

Loved your Monzi experience? Please get in touch. If unfortunately, you didn’t love your time with Monzi, we would love to hear where we could improve. Feel like you haven’t been given a fair deal? Let us know.

If you have more questions about how it all works? Head on over to our FAQ page. Additionally, find out more about our complaints and website policy.

Monzi loans, the simple, stress-free way to find legitimate lenders.

The best Australian loan finders

Discover Monzi

Finding your loan...